Table of Content

Use a refinance calculator to adjust your rate and loan term to determine the amount you could save off your monthly payment. Interest.com is an independent publisher and advertising-supported comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. Interest.com.com does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances.

Mortgage rates in Colorado are currently 4 basis points less than the 6.19% national average. The table below is updated daily with California refinance rates for the most common types of home loans. Atherton, CA — Housing, grocery and transportation costs in Atherton are all much higher than the national average. Housing is 55% higher than the national average, with a median home price of $537,872 and a median rent of $1,685. Some of the Services involve advice from third parties and third party content.

Should I Go Through A Mortgage Broker

By using the Services, you agree that Interest.com may collect, store, and transfer such information on your behalf, and at your sole request. You agree that your decision to make available any sensitive or confidential information is your sole responsibility and at your sole risk. Interest.com has no control and makes no representations as to the use or disclosure of information provided to third parties. You agree that these third party services are not under Interest.com’s control, and that Interest.com is not responsible for any third party’s use of your information.

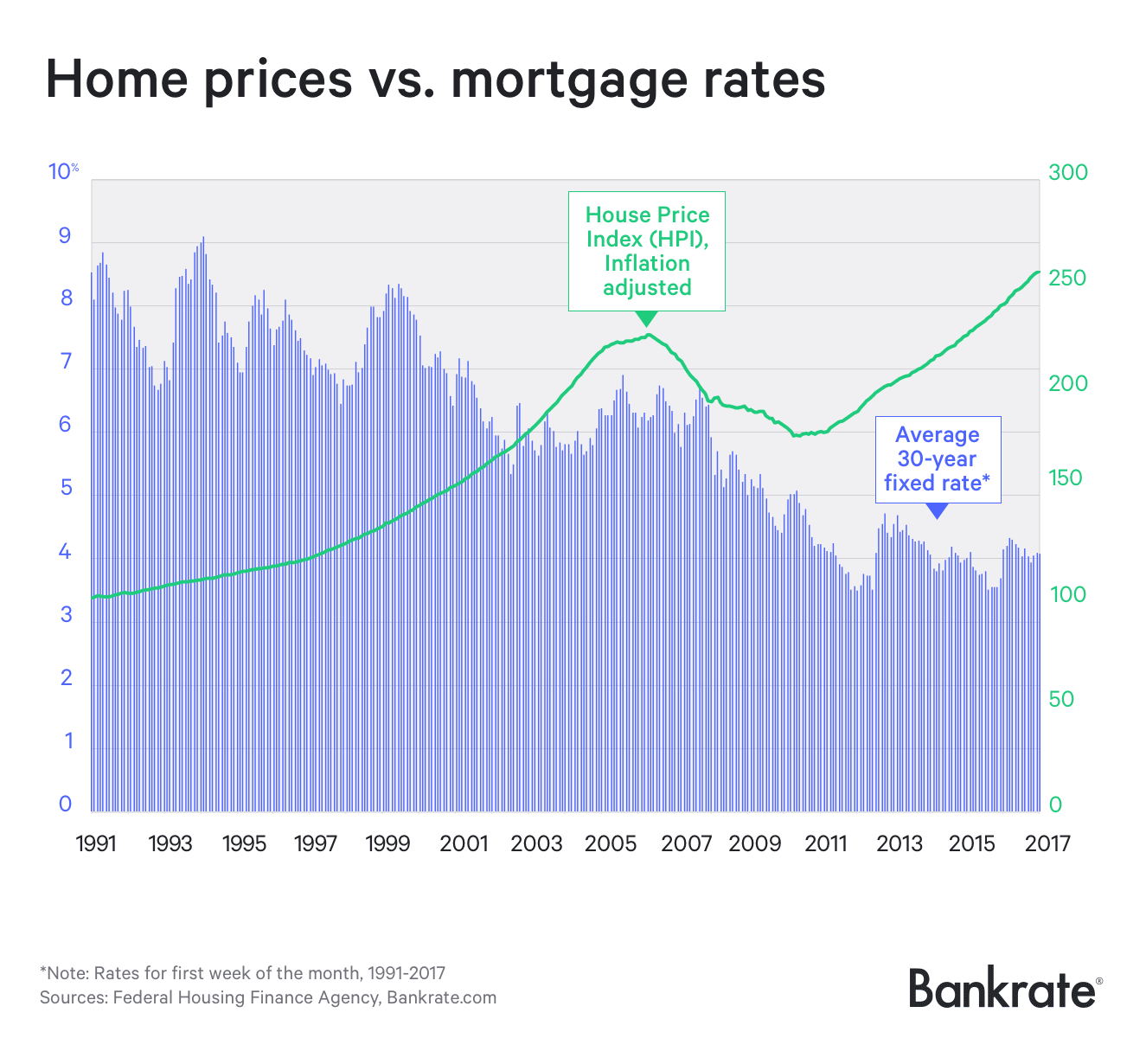

Adjust the graph below to see changes in average mortgage rates in California. You will purchase up to one mortgage discount pointin exchange for a lower interest rate. Connect with a mortgage loan officer to learn more about mortgage points.

Refinance Calculator

If you have specific questions about the nuances of applying for a mortgage, refinancing or buying a home in California, a mortgage banker or realtor licensed to work in the state can be a great asset. Calexico, CA — Living in Calexico is slightly more expensive than the other cities on this list, but is still well below the cost of living in the rest of the state. Barstow, CA — Barstow, which is halfway between Los Angeles and Vegas, is a small California town with an affordable cost of living. The median value of a home in Barstow is only $107,100 and the median monthly cost of ownership is $1,116. All fixed-rate loan products followed the same trend upward and then downward trend as the 30-year fixed-rate loans.

Current Mortgage Rates Sacramento – The process from filling out a mortgage application to getting a home loan can be a tedious, perplexing, and long procedure. However, the right mortgage lenders will treat you with respect and ease you through this sometimes challenging process. Indicators of the strength of the housing market and whether homes are becoming more or less affordable include the direction and rate at which home prices are changing. Currently, $558,900 is the median price of a home in the United States. Jason Lee is a seasoned copywriter with a passion for writing about banking, tech, personal growth, and personal finance. As a business owner, relationship strategist, and officer in the U.S. military, Jason enjoys sharing his unique knowledge base and skill set with the rest of the world.

What are the Current Mortgage Rates in California?

The most significant recent rate drop was on adjustable-rate mortgages. The average interest rates for 7/1 or 5/1 ARM loans are about 3.56% and 3.05% respectively. It’s important to keep in mind, though, that all of these rates assume a 20% down payment and a credit score of 740 or higher. Your exact rate will vary by lender, the type and size of the loan, and your creditworthiness. A 30-year fixed-rate mortgage is the most common type of home mortgage.

Colorado’s median home price in October 2022 was $558,900, an increase of 4.7% from the same month a year earlier. There were 7,455 homes sold in October of this year, compared to 11,458 homes sold in October of last year, a 34.9% decrease in sales on average. 32 days were the median days on the market, an increase of 10 over the previous year. Lastly, check California refinance rates daily to capitalize on the best refinancing opportunity. Homebuyers looking to move west or purchase a home in the state of California have several resources they can consult during the process. For starters, check out the HUD website for the state or the California Housing Finance Agency website.

How Does Mortgage Protection Insurance Work

When comparing online mortgage rates between different websites its important to know that each website has rates listed that are based on different home loan scenarios. And some websites have dozens of lenders listed which means each one of those home loan lenders has its own loan scenario. The benefit of an adjustable-rate mortgage is a potential lower mortgage rate and monthly payment. The above mortgage loan information is provided to, or obtained by, Bankrate.

Other expenses such as medical bills, college tuition, and home renovations can be covered too. Overall, applications increased, driven by increases in purchase and refinance activity, said Joel Kan, MBAs vice president and deputy chief economist. However, with rates more than three percentage points higher than a year ago, both purchase and refinance applications are still well behind last years pace. For people looking to buy a home, and homeowners wanting to sell, the retreat in mortgage rates over the past several weeks has been welcome.

In May 2018, interest rates for 30-year fixed-rate loans were at about 4.25%, and those rates are just above the 3% mark currently. Rates have been fairly constant over the last year, whereas many other states in the country have seen sustained drops. A famous perk of homeownership is that you can deduct the mortgage interest you pay when you file your federal income taxes. And, in California, you can deduct your mortgage interest on your California state income taxes, too. The state mortgage tax rules are the same as the federal rules, meaning you can get a double deduction for the qualifying mortgage interest payments you make in each tax year.

Estimated monthly payment and APR calculation are based on a down payment of 3.5% and borrower-paid finance charges of 0.862% of the base loan amount. Estimated monthly payment and APR assumes that the upfront mortgage insurance premium of $4,644 is financed into the loan amount. The estimated monthly payment shown here does not include the FHA-required monthly mortgage insurance premium, taxes and insurance premiums, and the actual payment obligation will be greater. Jumbo Loans - Annual Percentage Rate calculation assumes a $940,000 loan with a 20% down payment and borrower-paid finance charges of 0.862% of the loan amount, plus origination fees if applicable. Jumbo rates are for loan amounts exceeding $647,200 ($970,800 in Alaska and Hawaii).

We are responsible for providing readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. We maintain a clear separation between our advertisers and our editorial coverage. Our mission is to offer information to help readers make the best financial decision.

For those who want to maximize their dollars to ensure the highest return on investment, finding the right mortgage is essential. Some borrowers might think the best way to save money is to pay off their mortgage faster—by opting into a shorter loan term with higher monthly payments—but that’s not always the case. Most lenders require a home appraisal during the refinancing process.

The average California mortgage rate for a fixed-rate 30-year mortgage is 3.37% (Zillow, Jan. 2022). The lack of borrower liability for deficiency in California holds true in the case of a power of sale foreclosure. In the case of a judicial foreclosure there is a chance a judge would issue a deficiency judgement, but this too is rare and could be discharged in bankruptcy. California judges do not issue deficiency judgments on purchase mortgages for primary residences. A likely reduction of 25% in CMHC mortgage insurance rates could also boost affordability in 2023.

The 30-year fixed-rate mortgage averaged 6.31% in the week ending December 15, down from 6.33% the week before, according to Freddie Mac. A low credit score shows you pay your bills late and/or overextend your credit. If lenders take a risk on you, they increase the interest rate to make up for the risk. A fixed-rate mortgage is where your rate and your payment never change. If you already have a mortgage and are considering a refinance, get customized rates for your unique circumstances.

No comments:

Post a Comment